This is part of a sponsored collaboration with Prudential and DiMe Media. However, all opinions expressed are my own.

I was honored to be invited by DiMe who partnered with Prudential Financial for this important initiative. I was expecting to leave motivated and inspired, but the event exceeded my expectations!

I will share some of most important points for me and highlights that totally changed the way I view and handle money.

Understanding Your Value

How can you measure the value of all you do?

Just think about how many unpaid jobs you work just to take care of your family–Cook? Drive? Tutor? Housekeeper? Family accountant? It might take more than eight people to replace you as the multitasking home CEO. If you want to know the dollar value of the time you spend every week, click here to find out:

Planning For The Future

How to pay for college without sacrificing your retirement?

Which comes first – paying for college or saving for retirement? This is a daunting question for us as well as most of our friends. Some think college should take priority, while the others want to consider retiring overseas for a fun and peaceful life. However, those who prefer saving up for their retirement life, often find themselves engrossed in the IRA investment industry. This is not only true for those who earn in dollars but also for individuals from other parts of the world. By having an IRA (individual retirement account), which is a tax-advantaged investment account, individuals can save for their retirement. Additionally, they can invest in stocks, bonds and other assets like gold and silver (those curious to learn more about investing in precious metals, can search for Gold and Silver IRA Company Reviews on the internet) to increase their money. However, how the account balance grows over time depends on how the individual invests and how much he/she contributes to the IRA.

Anyway, if you are still torn between college savings and retirement plans, then here’s a quiz that can provide you with clues on how to pay for college without jeopardizing your retirement savings:

Interactive tools to help guide you through your financial life

It’s difficult for anyone to know how to begin the process of an overall financial plan. I know I’ve been walking in fear and not really moving forward, afraid that I don’t have anything extra to contribute, let alone to leave as an inheritance! Honestly, where do you go first when trying to develop a retirement strategy, evaluate your insurance needs or take steps to expand or in my case, start your investment portfolio? Here is an entire group of interactive tools to help you discover your own path:

What’s the value of a financial professional – Do I actually need one?

There are so many of us who live in the moment rather than thinking about the future. Some of our self talk includes: “I’m not going to grow old.” “Why not spend the money I earn?” “I deserve to pamper myself.” – that’s my favorite one!

That’s all well and good, until you want to buy a home, start a family or build a new business. Do you have any idea how to fund these ventures? Do you know who the best stock brokers uk are? Have you ever heard of a passive income before? Check out this video:

What You should know

Keep track of your financial history to avoid future problems

Your credit report and FICO score tell only part of the story. Do you pay your mortgage or rent on time? Are your medical bills lingering? Many people aren’t aware of where their financial history stands until they attempt to buy a home, take out a business loan or make a major purchase. Don’t let your financial history stand in the way of your future endeavors. Also, make sure to keep an eye on your credit score. This can be done by using the services offered by Credit Sesame. Maybe some people might like to read a credit sesame review beforehand. Hopefully, this will encourage more people to find out their credit score. Finances are so important, so it’s vital that people keep a close eye on theirs. Here are some rules of thumb to follow:

http://bit.ly/29iehWl

What You Should Do

How to build an emergency fund

Emergencies, accidents, and unforeseen events happen when we least expected, from health or dental expenses to sudden but necessary car and home repairs. An emergency fund serves as a safety net for those rough times. I’ve learned the hard way when we had the plumbing malfunctioning and the repairs cost $2,000,00. It was time for us to build an emergency fund. Every month I contribute to it, no matter what expenses we have.

Here are a few tips on how to balance paying the bills and saving:

What I did not know

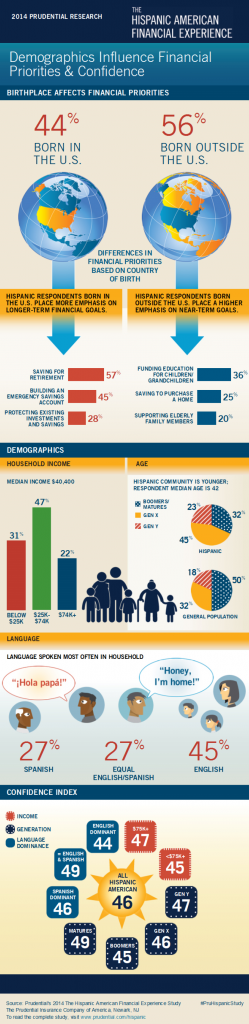

Hispanic Americans’ attitudes about retirement

Fear of debt and a poor understanding of workplace-based retirement plans are just two out of six reasons why Hispanic Americans may shy away from retirement plans. Get the stats from “Top 6 reasons for not contributing to workplace-related retirement plans,” an info-graphic from a 2014 study from Prudential. #WomenInspired

Now that you’ve learned some of the wealth of information shared at the event. I wanted to share my own highlights and key points that made this one of the most important events for me as a Latina and Business Owner!

Here is a short video of my experience and some snippets of the speakers.

The event began with sisterhood at its best with the Dime Team.

I found this sign which spoke to my heart, because YES, I own my own legacy!

I had the privilege to meet the amazing Mari (see last name) and briefly chat, learning all about her current plans and unbelievable media background.

The event embodied the true sisterhood and how Latinas and women need to form an alliance to grow and empower each other! I wanted to thank DiMe for inviting me to this amazing event and Prudential for gathering and providing such an amazing body of talented women to share their stories and knowledge with us!

I want to encourage you to join me and take control of your financial future in all aspects of your life! Let’s all join the #WomenInspired Movement and help other women and Latinas to grow, get a better life by learning their rights and taking the right steps on the road to a financial future that defies the current statistics for Hispanics!

Above all, the event inspired me to dare to dream and put into perspective that I can and will move forward towards my financial goals, now that I have the right advice and tools! It was a game changer for me!

What do you think? Is something holding you back? Do you think like I did, that you could not save, do not have/make enough to plan?

Can’t wait to hear your thoughts, as usual, give us a Trendy Shout!

Sounds like a great event! I used to work for Prudential, ( assistant General Manager). It’s a great company

What an empowering event. I definitely value any advice on planning for my financial future. I have many choices to make in the next few years regarding our finance, college for my girls, going back to school myself. It would be nice to have a little guidance.

This sounds like an amazing event that will inspire and empower a lot of women especially the moms. There’s also nothing like being prepared for the future.

What an inspiring event and so many great tips! I started doing a better job putting money away the past few years so I’m pretty proud of myself.

You look so beautiful! I think about having an emergency fund all the time. I have been trying to get a good stash in our savings account.

Sounds like a really great event. We always seem to be saving in an emergency fund but doesn’t seem to last long.

Most people plan as they get closer to retirement! Great post and sounds like an event I would have enjoyed. Love the infographic. Loved how you’ve broken it down 🙂

So many great tips!!! I often find myself worrying about an emergency fund! I’m so bad at putting money away!

Love the way you can check your monetary value for something that wouldn’t normally have a wage. So important to remember that time is valuable no matter what you do!

I worry about retirement, and an emergency fund is SO important! Thank you for sharing these tips for us to get prepared.

Great info. This is the kind of event that I would like to participate.

Sounds like a really great event! Looks like it would be fun to attend. Some great and importantinformation!

I love it when I leave an event feeling renewed and inspired! Sounds like you got some great info at this one, thanks for sharing it with us.

I love events that I can learn something from, and this sounds like this was one of those types of events. By the way, wonderful advice!

Some great advice. I can’t believe how fast time flies, and how close my husband and I are to retirement. There is so much to think about.

I think it’s so important to remember the tasks we do that don’t have a monetary value to them such as the things we do for our family. That doesn’t ever make them worth less!

I do think my husband and I need one. We aren’t suffering by any means, but I do know we could save and spend more wisely. It will also be better when I got a job.

What an amazing even to be able to attend. I love when companies that help to uplift women to be successful in life and accomplish their goals.

It sounds like it was really an inspiring and motivating event. I’m so glad you had the chance to go.

This sounds like it was an amazing event with a lot of helpful information. It is so important we save for our futures and our children’s college funds. Thanks for sharing the information.

What a great event! Educational and inspiring, financial planning is so important.

Oh yes, I have always thought that way myself. That I did not make enough to plan.

What an inspiring event! Sounds like there was a lot of important info there as well!

What an amazing event on such important issues we all think about. Understanding your value is so key!

This looks like a fantastic event and I agree that it is nice to be inspired!

It is so important to plan for your future. We have been putting money away for our retirement since we got married.

This is a fantastic post. I am so happy we started saving for the kids education when they were born. They are both in College now and it has not been as stressful financially as it could have been.

I love how they are offering us women such valuable resources. With so many financial aspects to life these tips really help out!

Understanding one’s value is so important. I love events like this that leave you feeling inspired and motivated. Being motivated to save for retirement is huge. Great message here.

There is lots of good reference information here.

Retirement planning is something to be taken seriously and made a priority.

These area ll great tips! I have been trying to put money away in the emergency fund, but I have been bad at it! I will be much more diligent at it.

Thank you so much for that awesome video montage!! I wish I could have been there!! I’m pumped from just reading your post!