![]()

Extremely excited to have attended Hispanicize in LA as a Prudential Brand Ambassador.

Such an interesting topic to me, since you know I am a huge advocate for health and wellness and living a healthy life!

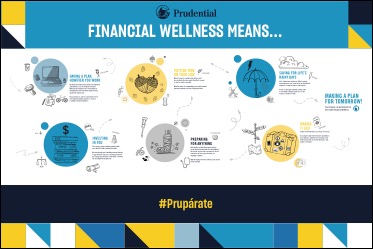

Prudential was able to define the financial wellness –

explaining that understanding and planning for our future starts from your household habit – the same way physical wellness starts with eating well and exercising!

Nothing more important than living a life in prosperity, taking the steps to live well, having your financial goals and dreams as a priority in your life!

As a Latino, you are not alone in your struggles with finances (42% believe they have different financial planning needs than the average American household). Not only should this be taken into account, but checking out estate planning assistance through an Estate Planning Attorney for later on in life, may be the way to go to help your finances remain where you want them to.

I loved watching the PIA (Positive Impact Awards), sponsored by Prudential to honor members of our community who are making a difference!

I really wanted to share with you how important it is to feel empowered with financial solutions so that you can be confident that you are making the right decisions for yourselves and your families

After checking out the Wall at the Prudential space and talking with one of their advisors, I learned some important concepts:

HAVING A PLAN, HOWEVER YOU WORK

By 2030, half of Americans will be self-employed, and without access to workplace benefits. Which means they’ll be more responsible for planning their own retirement and protecting against the unexpected.

The good news is, now it’s easier for self-employed like me to create a roadmap to financial wellness! YESS!

You might want to check out a life insurance retirement plan. What is a Life Insurance Retirement Plan? It is an over-funded universal or whole life insurance policy, which can get you many benefits, including tax advantages and hedging, tax-free death benefits, accelerated death benefits, long-term care, and many more.

You can learn more about retirement planning and insurance benefits HERE:

INVESTING IN YOU

The average college student graduates with more than $37,000 in student loan debt, which they will pay off through companies like SoFi.

But even though you’re working now and starting to pay off the loans, you can still pay yourself by putting away money for retirement. You might want to open a 401k, look for the best share trading app australia has to offer, or invest in property so you know you have something saved away for when you get older. – however far off it might seem right now, it’s never too early!

PUTTING TIME ON YOUR SIDE

When it comes to saving for the future, don’t procrastinate. Because, quite literally, it can pay to start as early as possible.

With the power of compounding, even small amounts put away regularly can have a big impact later.

PREPARING FOR ANYTHING

Nobody likes to think about what could go wrong. But we know that in life, stuff happens. One in four 20-year-olds can expect to be out of work for at least a year during their lifetime because of a disabling condition.

With the right protection, however, your income can be protected.

I absolutely loved the panel where Patty Rodriguez shared how she achieved a life of fire!

SAVING FOR LIFE’S RAINY DAYS

60% of Americans don’t have $500 in savings for unexpected costs, from out-of-pocket medical expenses to surprise home or auto repairs. That was us, before I started working with Prudential.

Create an emergency fund by setting aside 3 to 6 months of living expenses in a safe, easily accessible account.

I had a chance to talk about that on a recent video series I did with Prudential to help business owners start saving! Such a responsibility to share goals and dreams with Latinos to motivate them to be the best version of themselves and aim for the stars!

MAKING IT LAST

Today’s retirement lasts an average of 18 years.

If you want to have the freedom to spend those years however and wherever you want, you’ll need income that can stretch that long-and maybe a lot longer, because you never know!

Other Fun aspects of the Prudential Space were:

The Physical Fitness Spotlight when we watched our smoothies being made powered by the bike!

What inspires me the most about Prudential is their sense of community and how much they invest in our growth. Dorinda Walker embodies that mission, so truly honored to be a part of the team!

Have you started planning for your future?

Hope you check my video recap out!

Can’t wait to hear your thoughts!

As usual, give us a Trendy Shout!

I’m 44 and I have yet to start this. I really need to start looking into this myself z

We’ve always preached about planning for the future as early as you can. Both of our girls have already started saving for retirement!

I think it is awesome that you are a Prudential Ambassador. Planning for our future is important but gets put on the backburner more than it should. Thank you for all of the fact that you mentioned in your post, it is an eye opener.

This is a great motivator to plan better for our future. I’m not very well prepared beyond today, but Prudential sounds like a good way to go.

Planning for our future is very important to our family. It is something that you really can’t put off til later because we never really know when later could be. Thank you for sharing your insight with all of us.

These are all great tips. I do have have a retirement fund set up I just wish I would have started sooner.

Wow, that is such a cool smoothie maker!!! Looks like you learned a lot to pass onto us!

I love this! You have to have your finances in order. Most people have no idea where they stand. It’s almost like they’re afraid to know!

I need to learn more about this stuff. I know very little about the financial world and I need to budget better. This would be a great thing to go to learn more about financial options.