Trust me, you have money tucked away and you don’t know it! I know it’s true because I had it as well. Today I will share a few ways on How To Save Money Without Increasing Your Income.

How To Save Money Without Increasing Your Income

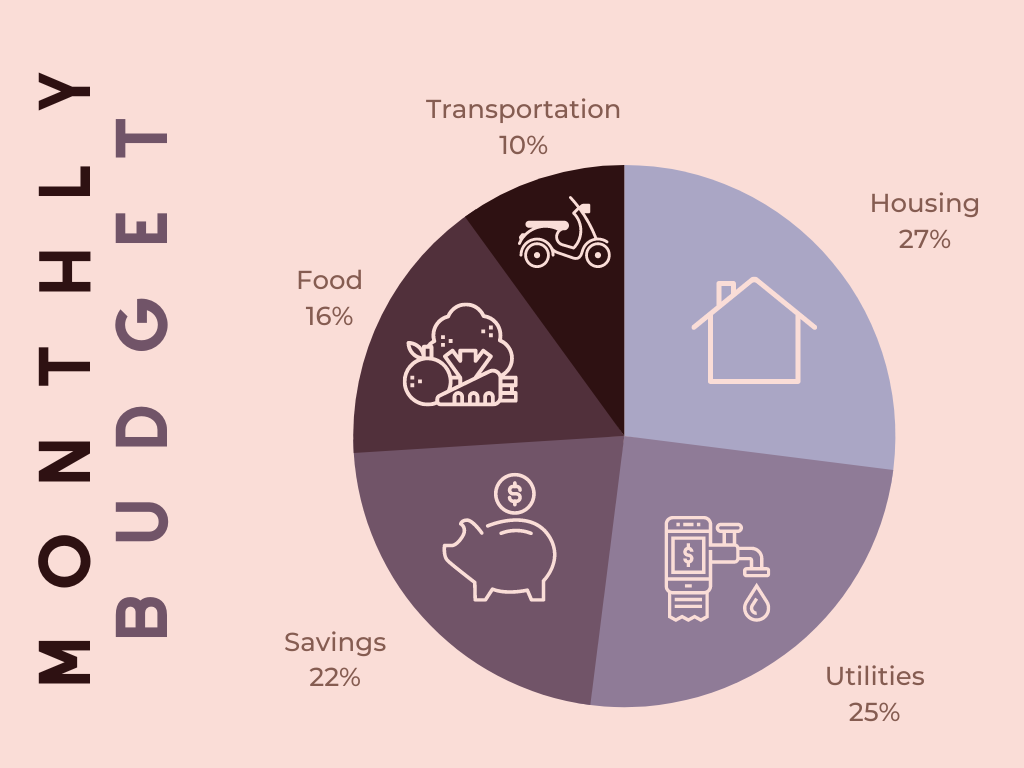

Food Budget

Even if you have to tweak the percentages above, saving on food needs to be your first focus, when trying to save money.

I know it’s kind of obvious, but you can eat better and healthier if you work on your food planning and establishing a budget.

When I started, we were spending $300.00/week or more and I looked at it and decided to aim to reduce my weekly food budget without compromising my health goals.

No cheap cans, no shopping at dollar stores for food, but being more frugal, stretching our trips to the store and using everything we had in the fridge as far as food and veggies and maybe pantry, before shopping for food again.

Here are more ways we saved on food:

I planned meals and used some of the left over veggies in my fridge.

I subbed mac’n cheese for veggie side dishes, changed protein options to less expensive ones like fish on sale, lean ground beef, pork chops, chicken thighs. For some reason, they were always on sale, every single week.

Subbed new Keto Recipes for recipes that used the ingredients I had in my pantry, because as you know, Keto can be expensive.

Save on eggs, I shopped locally for eggs, since eggs went up 400% in price in our area. I can buy fresh eggs for 2.00 dollar a dozen cheaper than the regular eggs at the grocery store.

Desserts only homemade, no chips or cookies for hubby. I make everything from scratch which saves us a lot!

Coffee:

Save on coffee pods, which are a luxury, (not an every day thing like in the past) and I find them cheaper at Aldi.

Did you know that Hispanic or South American Coffee is better, healthier because it has less grain mixed in like other brands? Yes, that’s my secret I am sharing with you today! A package of Pilon costs $3.00 where I live and it tastes way better than Starbucks!

Trust me, I know coffee!

So we went from $300.00+ a week to $110.00 or less per week, three months later. Eating healthier, better and fresher!

Let’s get started on saving money on food:

Write down your shopping list:

This section is in a larger font, because it is the most important part of my tips to help you save money when shopping for food!

*Remove canned items, artificial snacks, things you can live without

*Plan Your meals with a choice of protein, a vegetable side dish and a carb choice if you’re not on Keto

*Plan to go shopping 2/4 days after you would normally go back, look in the freezer, fridge and pantry and make it work!

*Look for alternative brands offering the same product at lower price

*Bring Cash – In the past I have not been able to do that because I would feel anxious about not having enough, but it’s a great way to keep your budget under control.

Save on Gas

You know gas prices are still out of this world, right?

Well, plan your trips out, combine errands and stops along the way for that one trip you had in mind.

We like hiking but we have been choosing closer hikes, to avoid wasting gas for the same experience.

Road trips only when we have a reason to stay overnight and make the best out of it.

Save on subscriptions:

After looking at my subscriptions, I saw I was paying for way more than we actually used and enjoyed.

This is an area where I saved a lot!

I looked through TV subscriptions, cancelled all the extras but Disney+, and I’m still debating on that one.

My library is a part of Hoopla, they are great for audible and e-books, so I can borrow a lot of books at zero cost! No, it doesn’t have all the brand new titles, but it offers a wide variety of options! So I cancelled my audible, which still kept all my books, which I can listen/revisit, I just can’t grab new paid titles without paying for it.

My son works, so I told him, he needed to put his card on his subscriptions or I would cancel them. I explained why.

I’ve also reduced and consolidated Spotify and Amazon bills, hubby and I now share accounts.

I’ve also cancelled satellite radio.

I also looked at extra things like manicures, trips to the salon and other extras and reduced as much as possible.

Save On Clothes & Shoes

Target was my go to place to buy clothes at least once a month, just because…

I stopped doing that, cleaned out my closets and found pieces that I hadn’t ever worn!

In my closets I have a total of over 50 pairs of shoes, so I figured this is an area I could save! So I have not bought clothes or shoes in over 6 months!

Hubby gave me some hiking sneakers as a Christmas Gift, but that doesn’t count, right?

Save On Household Expenses

Why not keep an eye on the electric bill, which is my largest expense?

We keep turning things off and it became a habit.

If you look at your home expenses, you’ll probably find other items you can cut, like shoveling your sidewalk, mowing your own lawn, washing your car, cleaning your home, etc.

Save On Pet’s expenses

I’ve started spacing out the grooming visits and following the vet’s advice to feed my dogs smaller portions since they were getting chubby.

I’ve also stopped buying pet outfits, since they have enough and asked in our local Buy Nothing Group for some dog needs, since people often give away brand new or gently used items there, like dog beds, sweaters, blanket and fences.

Save On Restaurant Bills

No more Door Dash, ordering out for us. Fees add up!

We decided to pick things up at the local deli or WAWA, when we need and cut out our eating out bill to only once a week.

Restaurant trips became a once a month treat on a date night, hubby and I plan to keep going all year, but that doesn’t mean eating lobster and steak, right?! This is a big one and can save you hundreds a month!

Save By Not Buying

Well, I have a Buy Nothing group in my town, so when I want something, I ask there first! Yes, 9 out 10 times, I get what I was going buy!

Ex. I wanted to boost my brain by working on large puzzles.

So I asked in the group and now I have 3 puzzles to get started! I will pass them on when I finish and ask for more afterwards! Plus I got a puzzle of Italy and France, places I want to travel with hubby in the near future!

Sharing is a beautiful thing! I love giving items there as well!

Don’t have a group like that? Ask friends! Ask a local facebook group! Somebody might have and not need what you were going to spend money on.

Label Your Savings

Label your savings with your reward, like Trip to Brazil! Cancel a subscription and send that money to your savings, so when you do, it will motivate you to keep doing it!

New habits are hard to form, as James Clear shared in Atomic Habits, so this way, the reward will represent an incentive to form a new better habit.

I hope my tips on How To Save Money Without Increasing Your Income help you save!

You can check out another post on saving HERE.

Not ready to start? Save for later:

Can’t wait to hear what you think!

As usual, give us a Trendy Shout!

Such great advice! These days I am trying to make everything homemade from snacks to meals, no restaurant food. I’ll follow your other tips as well,

There are so many ways one can save money and it’s true that every little helps.

These are some awesome tips for saving money! Budgeting is always crucial and getting rid of things you don’t necessarily need.

Amazing tips! Thank you so much…I am already doing a few of these tips, I need to prep my meals next, I am actually very excited to start.

Budgeting is soo important right now. The essentials like eggs are insane- especially if you buy organically. I’ll have to see if I can find local fresh eggs in my area. Thanks for these tips.

We need to be better about stretching our grocery shopping trips out and truly using up every food in our fridge and pantry. Saving money is hard but just like anything with practice becomes easier.

These are great tips, and I will be following some of these from baking more at home to looking at the cost of things as a whole and things that are small and add up.

I do a lot of these already but could do more! Great tips here!

Usually, we hear advice to increase income to be able to save money, but it is also possible to save a lot without getting a second job. I save a lot on food and clothes.