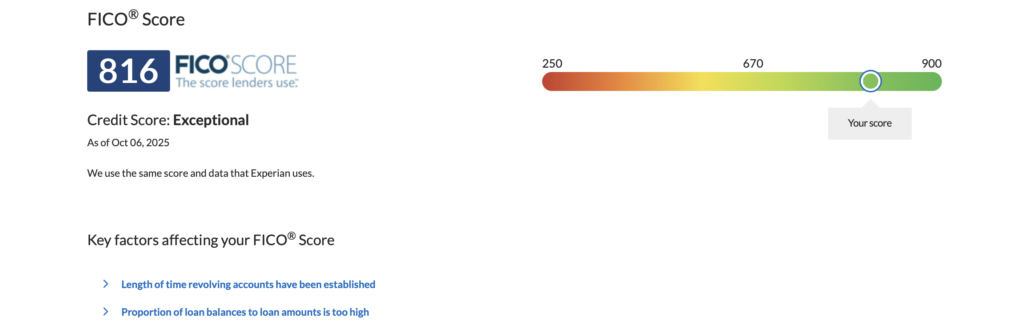

I’ve followed Dave Ramsey’s principles since 2021, and even though we were diligent and slowly paying off debt, still progress was little to none in 2025! Today I will share how I raised my credit score to 816 and how I managed debt to win.

How I managed Debt To Win

I’m going to start by telling you, Dave Ramsey’s financial peace course and books helped us to get started on our journey to get rid of debt.

Here are some of my updates as we moved along the Baby Steps:

After 4 years of diligently following the plan, our debt didn’t go down as much as we were paying it off and we got discouraged dishing out almost $500.00 a month in payments to see only $100.00 actually go into paying off our debt.

I finally decided to make changes and saw dramatic results that I will share with you today:

Change #1 – Consolidated Credit Card Debt Into A Lower Interest Loan

I know Dave and his staff are against this, but I am telling you, I went from paying $500.00 a month to paying less and seeing the debt decrease from $100 / month to now almost $ 300.00 a month.

My new loan had a 10% fixed interest rate, while some of the cards had a 27% interest rate.

Credit Card Debt counts very negatively on your credit score, so when I paid off the cards, I got rid of most of them, closed the accounts, and only kept one for emergencies.

My credit score went from 697 to 816 in three months! Contrary to what Ramsey and his staff preach, I do want to have a healthy high credit score.

Change #2 – Say No To New Debt

We decided not to take on new debt until the “consolidation loan” is paid off.

Change #3 – Spend Less

We lowered our Christmas Budget, cut vacation trips and made other sacrifices to ensure we were on track with our goals.

Change #4 – Send additional principal payments

The only other debt I have is my car payment, mortgage and a co-signed college loan. I have been sending additional small payments to the principals to reduce the life of the loans.

Small but gradual progress.

Change #4 – In Progress

I am going to close two more cards, just keeping one for emergencies or travel needs. I didn’t want to close them all at once to avoid my credit score from tanking, since one of the cards I plan to close is my oldest one.

I plan to continue to move the needle towards owing as little as possible to free up money to increase savings and investments in retirement.

Have you taken steps to live life without or little debt?

I can’t wait to hear from you!

Save this for later and let me know if you used my tips:

As usual, give us a Trendy Shout!

It is so important to make sure you are staying on top of debt. I am glad you found something that really helped you!

Best advice. Don’t buy using a credit card if you don’t have the money to pay it off. Well done for taking action and reducing your debt. My husband and I are debt free and that word “free” really is applicable – it’s freedom.

I’m trying to streamline my credit cards, so this is most certainly helpful. The 0% you need to stay on top of right away or it will bite you in the butt!

My husband and I have taken steps to lower our debt and increase our savings as well. We didn’t have any debt to consolidate, but paid off our vehicles years ago, and though we want a new one, we have kept the older vehicles.

I do love Dave Ramsey’s principles. Going beyond is so good like not getting rid of all cards at once and I think keeping one for an emergency is smart.

Thank you so much for the amazing insights! I am currently doing Tip #1, consolidating all my credit card debts, this is a huge one for me.

Paying off debt as you have demonstrated can be a long winded process. I haven’t come across David Ramsey’s course or books before. It sounds like you have managed to make more progress by looking at the debt practically. It makes sense to spend less on luxuries. It can really have an impact.

Wow these are amazing tips to lower debt. Your journey sounds progressive, these little changes certainly make a huge difference!

Thank you for being so open about this journey. It is reassuring to see that progress did not happen overnight, but step by step. Stories like this make it feel possible instead of overwhelming.

These are really great tips and advice to help lower any debt. Sending extra payments when you’re able to is a great way to pay off the debt quicker!

Lucy | http://www.lucymary.co.uk

I love your entire strategy. I don’t know why rolling debt into a lower-interest loan gets so much negative feeback. It’s a sound strategy. We’ve done it, too.

I love the additional principal payments idea! I have been doing that and should be able to pay off my mortage this year- God willing!

These are really great tips for lowering debt. It is often so much better to take a consolidation loan. You pay out far less that way.

These are great tips. Sending extra payments whenever possible really adds up over time!

That’s a good tip to not close out the credit cards you don’t need all at once. It is also so enticing to open those cards when companies give you a huge % off or cash back but don’t fall for it.